salt tax cap married filing jointly

The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. Be Sure to Hire Someone You Can Trust with Your Taxes.

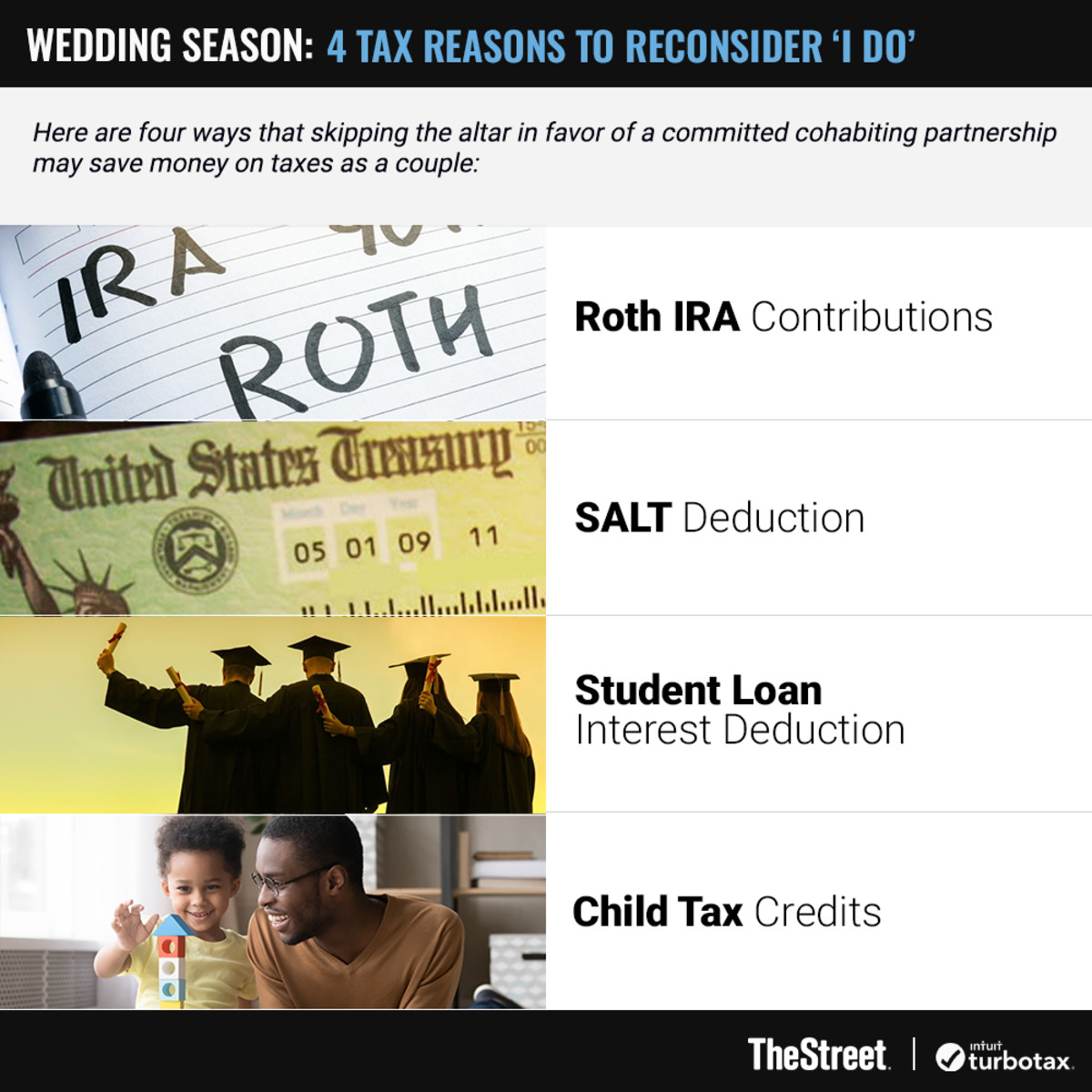

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

The limit is 5000 if.

. For example if you are a person with a Single filing status taking the largest possible amount for your SALT deduction at 10000 the total amount of the rest of your itemized deductions. The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. Married couples filing jointly.

Under tcja the salt deduction. Trying to figure out how much of our 2018 state refund. Under TCJA the SALT deduction was capped at 10000 for single filers and married couples filing jointly.

Single taxpayers and married couples filing separately 6350. The measure dubbed the Restoring Tax. Ad Holistic approaches to wealth management including tax planning and goal setting.

Is it 5000 for Married Filing Separately. However Becourtney said the 10000 SALT deduction limit is only applicable to taxpayers with a single married joint or head of household filing status. Hello Its my first time filing a joint return for 2019 year.

Married couples filing jointly. In the 2017 Tax Cuts and Jobs Act the federal government. The arrival of the TCJA meant that the standard deduction amount was increased which reduced the number of taxpayers eligible to have deductions and capped the overall SALT.

The proposal also addresses an unfair marriage penalty where two single filers could each claim a 10000 SALT deduction but once they marry and file jointly theyre still. T he state and local tax SALT. The measure dubbed the Restoring Tax Fairness for States and Localities Act or HR 5377 proposes increasing the so-called SALT cap to 20000 for married taxpayers.

52 rows The deduction has a cap of 5000 if your filing status is married filing. My partner and I each received 1099gs in a high tax state. While the TCJA included some tax provisions that reduced the married tax penalty as stated above the 10000 SALT limit increases tax on married taxpayers filing.

Head of a household. As a side note it is a 10000 limit for the. It is 5000 for married taxpayers filing separately.

It is 10000 for all other filing statuses. June 6 2019 620 AM. Ad We Can Help File Your Tax Returns.

Head of household filers and married taxpayers filing jointly. Ad E-File Your Taxes for Free. Under TCJA the SALT deduction was capped at 10000 for single filers and married couples filing jointly.

New tax law for 2018. For married taxpayers filing separately the cap is 5000. Free estate plan for clients with 15M in assets under management.

The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately.

What Is The Salt Deduction H R Block

What Is The Salt Deduction H R Block

Irs Tax Brackets 2022 Married People Filing Jointly Affected By Inflation Marca

F 1 International Student Tax Return Filing A Full Guide 2022

Home Ownership Matters 3 Key Changes For Homeowners Under The New Tax Law Key Change Homeowner Change

Wedding Season 4 Tax Reasons To Reconsider I Do Thestreet

/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

Average Tax Rate Definition Taxedu Tax Foundation

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

The Salt Deduction There S A Baffling Tax Gift To The Wealthy In The Democrats Social Spending Bill The Washington Post

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

Wedding Season 4 Tax Reasons To Reconsider I Do Thestreet

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

Wedding Season 4 Tax Reasons To Reconsider I Do Thestreet

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

Average Tax Rate Definition Taxedu Tax Foundation

Wedding Season 4 Tax Reasons To Reconsider I Do Thestreet

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty